Buy a Business

Achieve or Exceed Your Acquisition Goals

We Optimize Your Business Acquisition Success using our unique ‘Agifall’ Approach

Agifall M&A is a New York based Mergers and Acquisitions (M&A) advisory firm. We represent strategic buyers, sponsors, funds and HNW individuals who want to acquire an existing business. Our team brings decades of top tier (Big 4) Mergers & Acquisition (M&A) expertise to the acquisition of lower middle market companies.

Our firm is founded on the disruptive concept of applying an ‘Agifall’ approach to M&A. Agifall (pronounced ajĭ-fall) is a software development method that combines the step-by-step waterfall approach and the iterative agile approach. Applied to M&A, we balance agile speed with a well planned acquisition strategy to maximize your outcome. Click to learn more about us.

Unrivaled M&A Services

50+ client deals ($1M to $50+B)

20+ years of M&A expertise

- Each advisor min. 7 yr experience

Unparallel network reach to source the highest number of target sector deals

Services support entire M&A life cycle

- From pre-purchase target selection to ensure purchase goals are met through post-close transition‘Agifall’ Approach to tailor services to your unique goals for the right support at the right time at the right price

Should You Use a M&A Advisor to Acquire a Business?

What Does a M&A Advisor Do?

A M&A advisor represents the buyer (or seller) in the purchase (or sale) of a business. A buy-side advisor will source target businesses that fit buyer’s acquisition criteria, advise on the valuation (price), propose an offer to seller, negotiate, and manage the due diligence process and closing.

The typical buy-side advisory fee is a monthly retainer and a Success Fee, which is a commission (comprised of a percentage of the transaction value). Some firms offer a ‘No Money Down’ commission option in exchange for a ‘hands-off’ approach where the advisor doesn’t perform a significant amount of work before a purchase offer is accepted.

Use a M&A Advisor if You Want:

Confidentiality

Don’t want your employer / employees to know your plans? Your M&A Advisor acts as your intermediary, engaging potential sellers so your identity is hidden.

Save Time / Speed

Selling your business is a 2nd job - fielding calls, building financial models & marketing materials, etc. Let your broker handle the purchase so you can focus on your work and finances to optimize your purchase position.

Highest Pay-Out

Expertise and an extensive network are required to source appropriate on and off market targets, assess the target business’ value, and to propose and negotiate a price and deal structure that will be accepted and financed, and will achieve your purchase objective.

Prevent Deal Ending Errors

M&A can be a complex road with deal breaking pot holes. Skilled advisors can identify and flag hidden problems, negotiate with sellers and other stakeholders, and structure the deal to protect your interest.

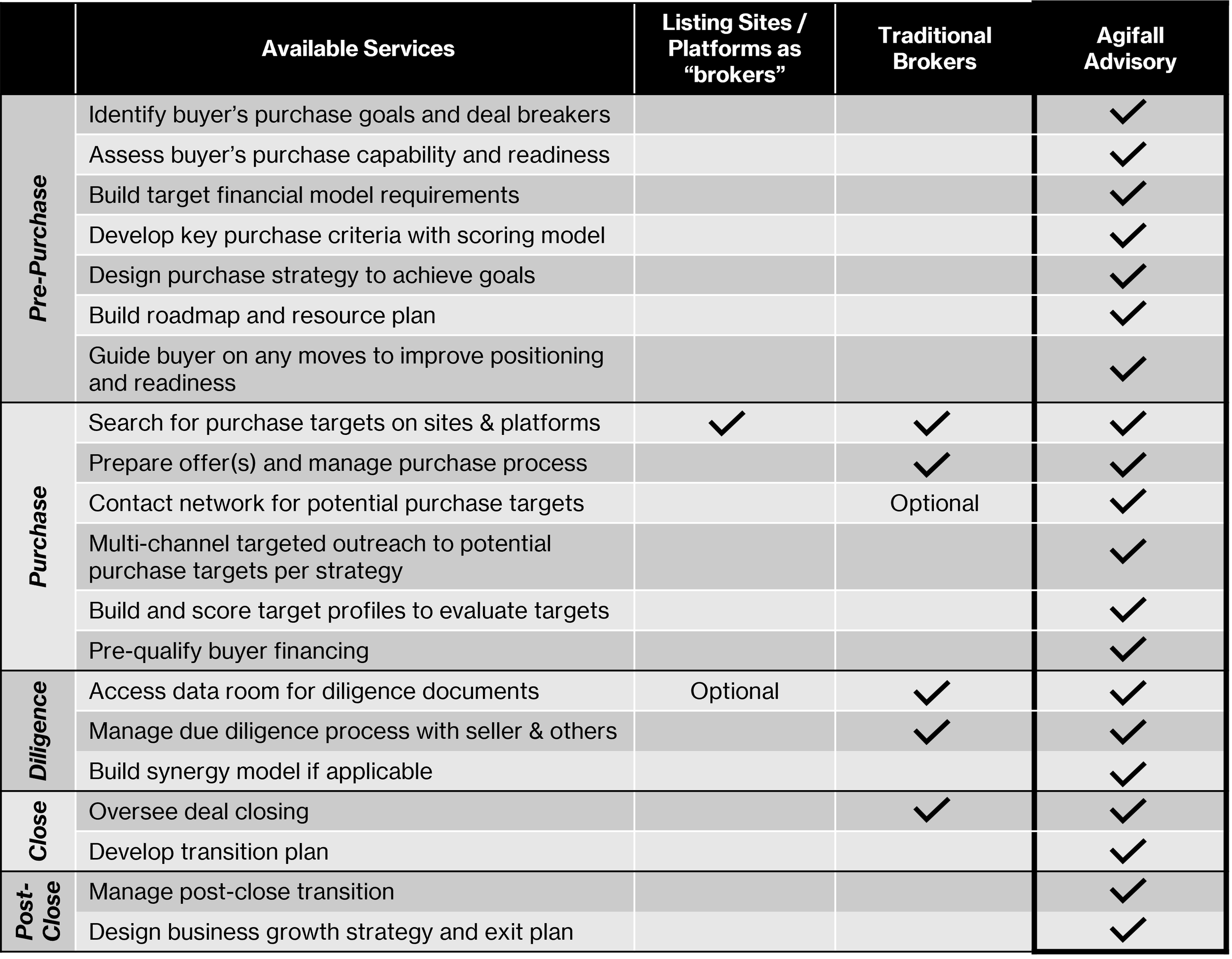

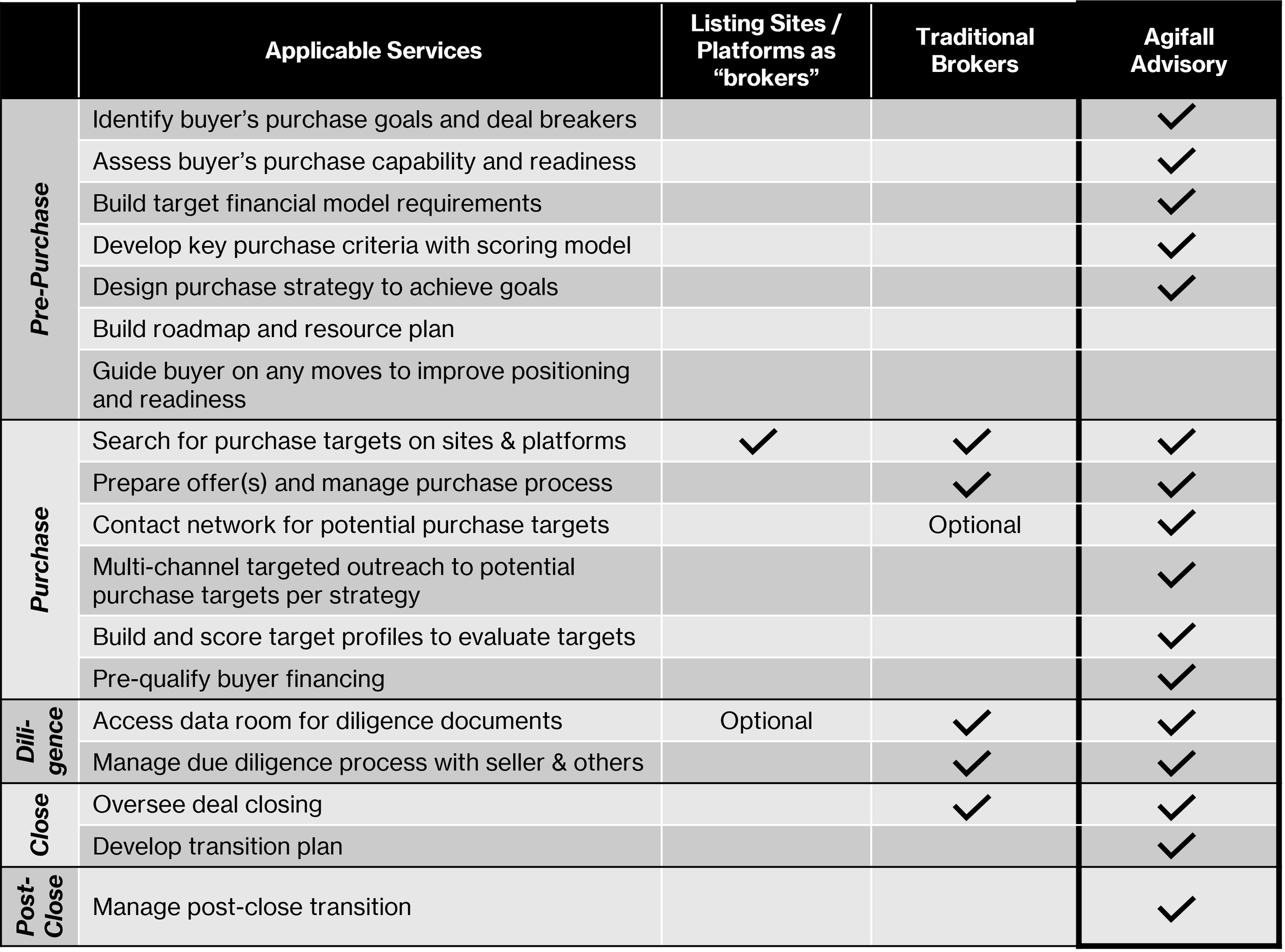

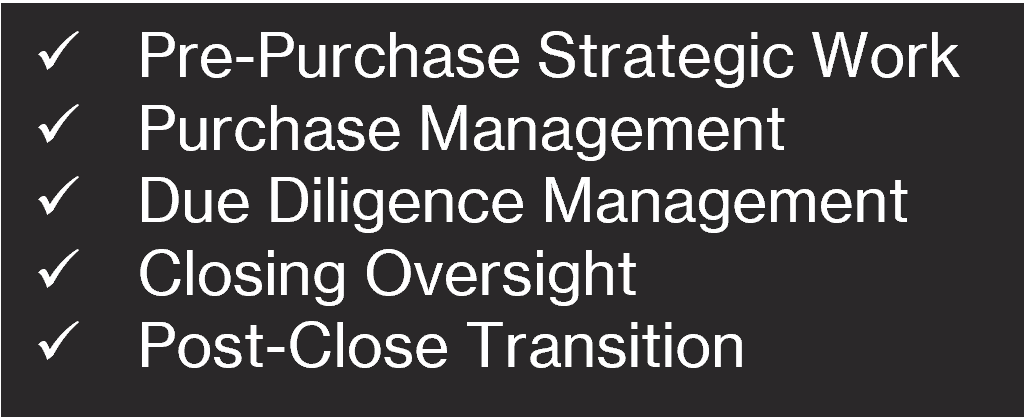

Our Service Offering

Get More when You Engage Us

In a world of limited buy-side broker services, we specialize in helping buyers identify the type of targets to buy (in pre-purchase preparation) to achieve buyer’s goals. Why? “Before anything else, preparation is the key to success.” – Alexander Graham Bell

How Are We Different?

An Unrivaled Service Offering + Expertise and Approach to Ensure that You Achieve or Exceed Your Goals.

We’ll scale up and down where needed to deliver a highly tailored experience. You can be as hands-on or hands-off as you desire. You won’t find a curated M&A experience like ours anywhere else.

Most Service Offering

+

Top Tier Expertise

+

Breakthrough Approach

Achieve Your Purchase Goals

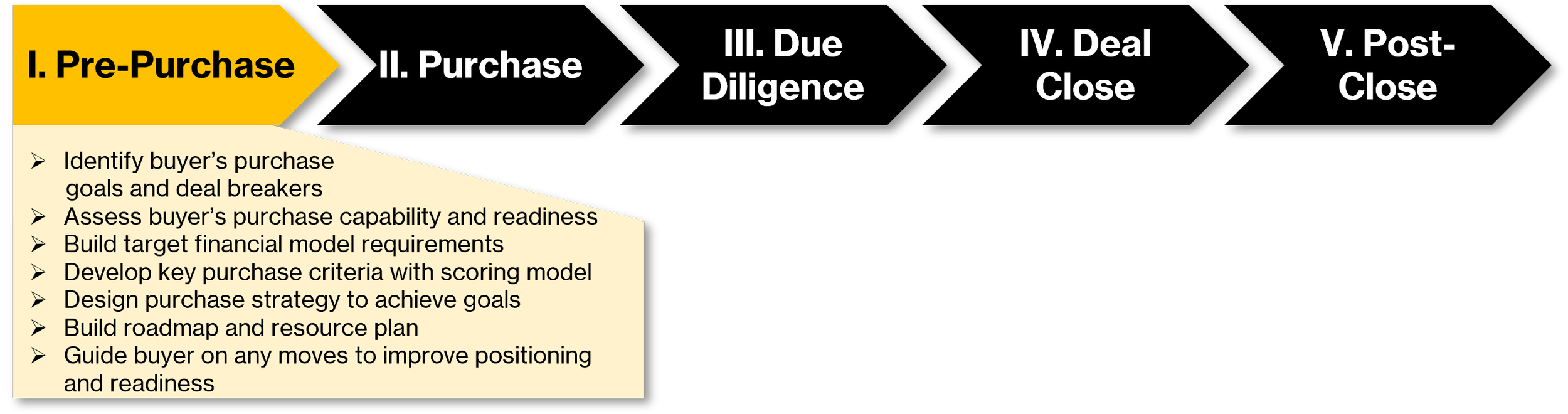

How Does It Work?

“The journey of a thousand miles begins with one step.” — Lao Tzu

Milestones:

Phases:

Activity Steps:

Begin your journey with a free introductory conversation. The purpose of this call is to understand your purchase goals. This understanding will enable us to broadly outline a high level strategic approach for your purchase. From there, we’ll align with you on what your true needs are and together, select the services that will give you the right support at the right time at the right fee to achieve your goals.

Once you engage us as your M&A partner, your next step is simple - let us handle the M&A process for you. We believe that success results from all parties ‘leaning in’ to our respective areas of expertise. Your focus should be to maintain and grow your finances to optimize your ability to compete for and purchase desirable businesses. Our focus should be to help you purchase a business that will achieve or exceed your purchase goals.

We’ll begin with building a purchase strategy that’s uniquely tailored to you and your goals. And unless you opt to be heavily involved, our “job” will be to manage the complex M&A process and bring you in for critical input and decison making.